September Spot Rates

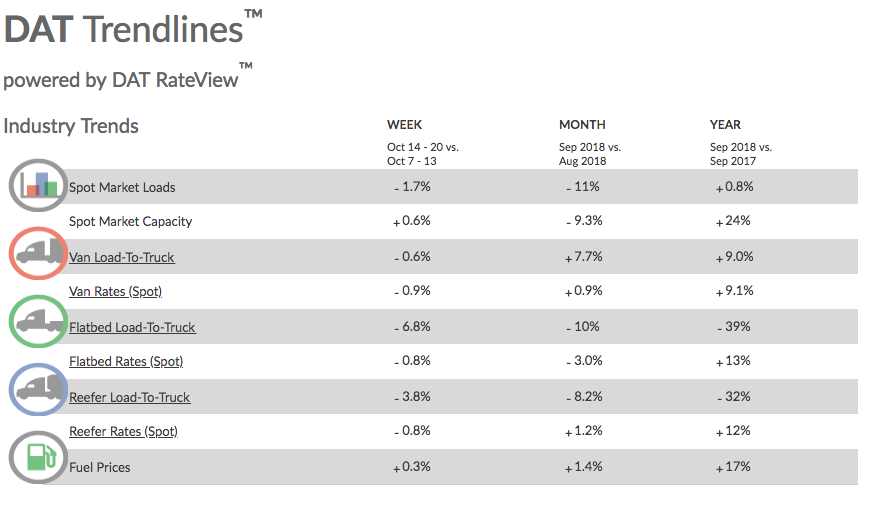

This past September showed some noteworthy changes in terms of spot rates. September showed a significant drop in terms of spot market loads in comparison to the previous month of August. The spot market loads from the month of September dropped 11 percent in comparison to spot market loads that were seen in the month of August.

Spot market capacities

When it comes to spot market capacities in September versus August, significant drops were seen as well. The month of September showed a drop of 9.3 percent in terms of spot market capacities over the month of August.

Flatbed and reefer load-to-truck figures

Spot market statistics were not the only statistics to show significant drops in September over August in the world of trucking. Both flatbed load-to-truck and reefer load-to-truck statistics showed significant drops in September as compared to August. In terms of flatbed load-to-truck statistics, a drop of 10 percent was seen in September as compared to August. In terms of reefer load-to-truck statistics, a drop of 8.2 percent was seen in September as compared to August.

Van load-to-truck figures

On the other hand, there was actually an increase in van load-to-truck statistics in September versus August. The total rise between September load-to-truck statistics was 7.7 percent between September and August.

Spot rates

That being said, there were smaller changes in terms of spot rates when it comes to van, flatbed, and reefer rates. Van spot rates rose almost 1 percent for a total of 0.9 percent in September as compared to August. While flatbed spot rates dropped 3 percent in the same period, reefer spot rates actually rose 1.2 percent over the same period.

Fuel prices

In terms of fuel prices, there was a slight increase of 1.4 percent seen in September as compared to the rates that were seen in August.

That being said, fuel price statistics showed a more significant rise when analyzed from mid-October as compared to the end of September and early October. There was a rise of 2.2 percent in fuel prices when you take statistics from October 7th to 13th as compared to statistics from September 30th to October 6th.

Flatbed, van, and reefer demand

Overall between the past weeks and August, demand has fallen for all categories including flatbeds, vans, and reefers. It's notable that Hurricane Michael has had a significant impact on freight flows throughout all markets in the Southeast of the country. In fact, the Hurricane actually closed down important portions of both I-75 and I-10 so that ratios were forced to plummet significantly.

Spot market statistics

It remains to be seen what changes will be seen in the rest of October. So far, it has been seen that spot market capacities have risen overall slightly in early to mid-October. Spot market loads have risen 1.5 percent in the week of October stretching from the 7th to the 13th in comparison to spot market capacities from the week of September 30th until October 6th.

On the other hand, it's important to note that spot market loads dropped significantly in comparison from mid-October to mid-to-late September. Spot market load rates dropped a total of 13 percent when you take statistics from October 7th to 13th as compared to statistics from September 30th to October 6th.