November Spot Rates

Statistics on spot rates in the month of November show general rises across the board for the last week of the month. The spot market loads rose by 54 percent in the week from November 25th to December 1st as opposed to the preceding week of November 18th to November 24th. Also, spot market capacity rates show a jump of 21 percent between the same periods. The biggest rise considering differences between flatbed, reefer, and van load-to-truck trends was seen in the flatbed load-to-track statistic with a rise of 51 percent for the last week of November.

Although a distinct rise was seen in the last week of November for many statistics, there were quite a few drops seen in rates when the month of November is compared to the preceding month of October. There was a drop in overall spot market loads between November and October of 1.8 percent. There was also a drop of 10 percent in spot market capacities. At the same time, a rise of 14 percent was seen in the van load-to-truck statistic in November compared with October.

Comparing November of 2018 to November of 2017, we see that the statistic for spot market loads dropped by 8.3 percent. Also, van load-to-truck, flatbed load-to-truck, and reefer load-to-truck statistics all show a significant decrease. At the same time fuel prices rose in November 2018 compared to November 2017 by 13 percent. That being said, fuel prices dropped slightly in November as opposed to October with a drop of 2 percent. Fuel prices also showed a slight drop in the last week of November as opposed to the previous rate by 0.6 percent.

Source: DAT

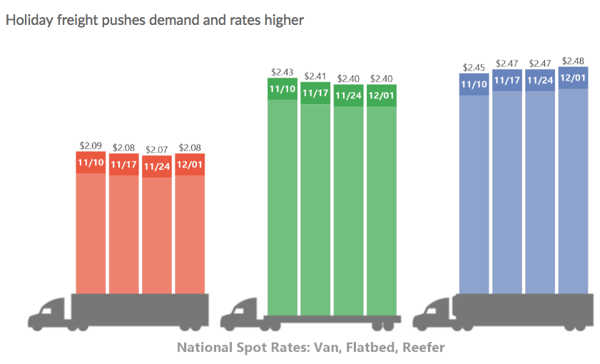

Van spot rates, flatbed spot rates, and reefer spot rates all increased slightly in November 2018 as opposed to November 2017. Flatbed spot rates showed the largest changed with an increase of 3.4 percent.

The rise for demands was seen to be especially strong, likely due to retail and e-commerce business demands as a result of the approaching holidays. The national flatbed rate stayed level in the last week of November. This marks a final end to the eight week drop that had been seen in this statistic previously.

Many of the November spot rates are typical responses to the holiday season. For example, truck and load posts naturally were expected to show an increase right after the Thanksgiving holiday. For load posts, there was an increase seen of 39 percent. Also, post for trucks showed an increase of 23 percent in the week after Thanksgiving.