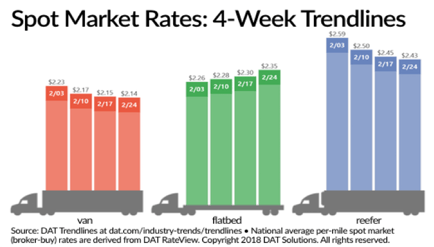

February Van, Flatbed and Reefer Rate Trends

For the third consecutive week, the national average for spot flatbed loads increased. Over the last month, van and reefers continued their small decline. The thing to remember is that both van and reefers are at higher points than they were last year, so the decline objectively isn't bad for the industry.

The flatbed load-to-truck ratio went above 70-to-1 over the last week. The number of flatbed loads also increased by 1/10 relative to last week's performance.

DAT found that while the load-to-truck ratio increased by 1/10 last week, the national average for flatbed rate gained five cents, bringing it to a total of $2.35/mile, including fuel surcharges.

Keep in mind, before getting into declines, most declines were very small and put rates at a better position compared to last year. Although refrigerated freight and van rates went down slightly, they're still in a relatively strong position.

The average van rate only dropped one cent per mile, which brings it to $2.14/mile. A small decline in the number of van loads, as well as a one percent gain in available capacity, tracked with the average van rate drop. At the same time, the van-to-truck ratio fell by over six loads per truck.

What about reefer rates? The average reefer rate lost two cents to bring it to $2.43/mile. Available loads dropped two percent amid a load-to-truck ratio of 9.3-to-1 over the last few weeks. Still, the decline in the average cost of diesel fuel helped to improve the overall performance of freight rates.

In general, pricing has been steady across markets and the declines in van and reefer rates were moderate and not far removed from last year's numbers. More promisingly, the national average for spot flatbed loads shot up for the third straight week.